ST. GEORGE – The Board of Education for the Washington County School District approved a 3 percent tax increase during a public Truth-in-Taxation hearing Tuesday held at the school district offices, 121 West Tabernacle Street in St. George, despite opposition from the Utah Taxpayers Association and others. The tax will be included in the county’s 2015 property taxes.

The tax hike is the second increase in Washington County property taxes for school district purposes in two years, in addition to a voter-approved $185 million construction bond passed in 2013 which is repaid by the taxpayers funds are issued.

Read more: School district seeks property tax increase; 2nd bump in 2 years; public hearing

Less than 15 members of the public spoke at the hearing; teachers and former teachers in favor of the tax increase outnumbered other members of the public more than 3 to 1.

“There is an essential link between strong public schools and a strong economy,” Amy Barton, school district teacher and president of the Washington Education Association, an affiliate of the Utah Education Association, said. “Investing in public schools stimulates the economy in all the communities in the county.”

School employees spend their dollars locally, Barton said, supporting local businesses and helping the recovery of the local economy.

“When businesses look to relocate or expand,” Barton said, “a top reason that they give in choosing one city over another is education. Businesses want to operate where they can find a qualified pool of employees.”

A recent World Bank study showed that investment in public education gives a 14.3 percent return on taxpayer investment over a 10-year period, Barton said, while stocks only return an average of 6.3 percent.

Others spoke against the tax hike, including Utah Taxpayers Association President Sen. Howard Stephenson, R-Draper. Stephenson owns a second home in Washington County and also serves as chair of the Utah Legislature’s Public Education Appropriations Subcommittee.

“For you to now add this tax adds insult to injury,” Stephenson said. “(The legislators) are doing all we can to support you. I think this idea of adding a tax every year is just insensitive to those who have supported you the most.”

Stephenson said the truth had been spoken at the hearing, but not the whole truth. In response to a comment about how Utah should be “ashamed of being dead last” in per-pupil spending, Stephenson said that statement needs to be put into perspective.

“Utah has increased its spending per student, after adjustment for inflation, since 1970,” Stephenson said, “we have doubled our spending per student.”

“If you look at the administrative overhead costs and the other costs in Utah, you will see that we are very competitive,” Stephenson said.

Clint Frei said that he appreciates teachers for excelling at “making a silk purse out of a sow’s ear,” and they deserve adequate compensation.

“That being said, my salary has not increased 9 percent in the last two years, and I doubt the average middle class salary has increased 9 percent in the last two years,” Frei said, referring to the total of last year’s increase of 6 percent added to the current tax hike of 3 percent.

“I feel like this is asking too much,” Frei said. “They asked for money last year, they asked for a bond, and I think there are other ways to properly compensate our teachers through administrative … cuts or things of that nature. I think this is asking too much of the taxpayer.”

Claudia Empey did not say whether she was for or against the tax hike, but still spoke to the board.

“Even with the increases in salaries for teachers, new teachers still qualify for free and reduced lunches with the kids that they have,” Empey said. “That’s something to keep in mind.”

School district officials said the tax hike was needed to help the district catch up with inflation, and to prevent further depletion of the district’s rainy day fund, a move that is needed to maintain the district’s bond rating, district business administrator Brent Bills said at the hearing.

Rather than raising taxes a little every year, Stephenson said in a previous interview, the district should wait until there are significant needs, and then propose a more substantial tax increase. Identifying specific needs for a tax increase can generate more community support, Stephenson said.

It’s appropriate to make adjustments for inflation every five to 10 years, Stephenson said, but doing it every year makes a mockery of the Truth-in-Taxation process.

School districts, cities and other government entities have the power to collect property taxes. To increase taxes, an entity must hold a hearing to take public comment, but is not legally bound by comments received.

About the Washington County Board of Education

The Washington County Board of Education was established under the authority of the Utah Constitution and consists of seven members elected by district to four-year terms. The last general election for the school board was held November 4, 2014, filling four seats. Three seats will be up for election in November 2016.

Among the enumerated authorities and responsibilities of the board, the Board of Education is authorized to levy taxes to fulfill its obligation to provide for public schools within the District.

St. George News Editor-in-Chief Joyce Kuzmanic contributed to this report.

Related posts

- School district seeks property tax increase; 2nd bump in 2 years; public hearing

- School district honors retiring teachers, hears dual immersion report, comment on baseball field

- On uncommon ground; common core in Washington County School District, 2014

- Letter to the Editor: School bond benefits everyone – 2013

- School District asking voters to approve $185 million bond for new schools -2013

Email: [email protected]

Twitter: @STGnews

Copyright St. George News, SaintGeorgeUtah.com LLC, 2015, all rights reserved.

what happened to republicans being against new taxes. That was common ground which we shared. Breaks my heart 🙁

TRUMP FOR PRESIDENT

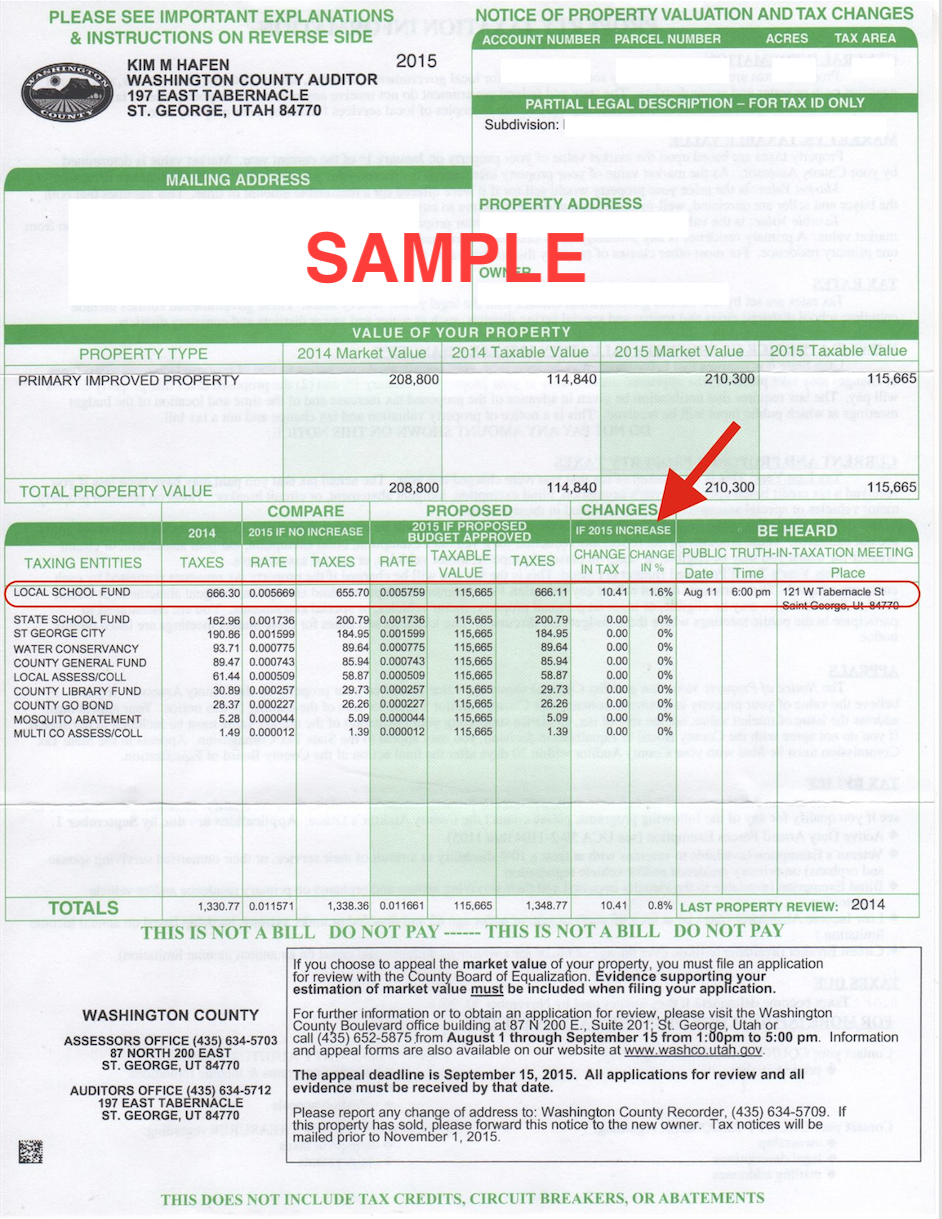

I got my property tax statement. It shows a column of what I paid this year, then what I’ll pay next year if there is “NO CHANGE”, and it’s $80 more. What part of NO CHANGE do they not understand? Then there’s a column that shows above $50 above that if there is a change. Now there’s change you can believe in. I hate property taxes because you can never truly own your house and land, you have to rent it back from the government forever and ever. Tax increases at every level on every item will go through the roof in the next 0 – 10 years, to the point of being ridiculous and painful for 99% of American’s. Its unavoidable.

I don’t mind paying a little more for a better tomorrow, but it would be nice to see the schools act more responsibly with the money they are given. I live in close proximity to a high school and see tennis courts lit up on weekends, ball fields lit up all night, they have an elaborate Astro Turf football stadium with the school’s logo like they’re some big time NFL team, there is even a church building on, the school property and would love to know if I am footing the bill for that!

How sad. People elected to solve big issues doing it the same old way we see time after time by raising taxes. No hard work going on here. Mark my words, you will see a tax increases and bond proposals every year from now on with this board. They know the people will not protest and will forget by election time about the tax increases. Maybe Sen. Stephenson will have the clout to bring change how government entities can levy taxes on the people.

The following comment is from Gary about the bond proposal in St. George News Paper, Oct 21, 2103. Obviously he was thinking far more ahead than those on the board when they proposed the bond measure:

Gary November 4, 2013 at 8:52 pm · Reply

“One thing to remember is that if/after the bond passes, people will need to be hired to staff these new facilities. Taxes will certainly need to be raised to pay these wages, pay the power bill, pay the water bill, and the myriad other costs of these new schools. Please do not delude yourselves into thinking it is ONLY the bond issue.”

I guess we all now know what the truth is about passing a bond measure means to support our schools.

If you need it, I will give it. But first prove it.

election year they won’t raise them but watch out the year after that

Really makes me mad that a letter from hurricane middle school said they can’t start school on the 13 like every one else because of the construction work they did on the school including extensive landscaping out side the school i didn’t see one problem with the way the school was the money they put into extensive landscaping could have been spent on new books update computers or something else that actually has top do with teaching the student.Yet here they are bumping up our taxes again for the third year in a row and they will probably raise them again first chance they get .

Really? Now that is a story I want St. George New to cover. Why isn’t HMS ready to start the same day as everyone else? Will the kids have to make up the days they start late? I want some accountability why my Hurricane neighbors aren’t getting their education as my tax dollars are paying for it.

i bet if mormons had to pay for their own kids’ schooling they wouldn’t have 8 kids to begin with. Honestly I’m tired of paying for them. They should pay for their own kids. Illegals and their anchor babies can just be deported cuz i don’t wanna pay for their schooling either. Next school board election i’m voting out the incumbents. These guys/gals just totally suck. Tax and spend republicans worse than liberals and i’m tired of it.

I have to agree with you. Tax and spend republicans are worse than liberals.

How is this wasteful spending any different than when you right-wingers are whining about Obama throwing away money on all the crap he does? If you republicans don’t come out against this you are as bad as the Obama that you whine incessantly about. Vote out these awful tax and spend republicans. vote no new taxes!

Not to mention the enormous amounts of new houses built every year and the rapidly expanding population of stg and wash co., leading to a huge new tax base. Why in the royal blue hell do they need to increase the percentage???? It just makes no sense….

..” People just don’t … get it. And especially nowadays where a teacher is teaching 10, it’s not just an 8 hour job it’s not a 6 hour job. It’s a …,any really good teacher is in there 10, 12, 14 hours a day. They’re grading papers that most of you who … about teaching couldn’t sit down and get through 3 of them. Okay”?

“It all starts there, that’s where it starts. It starts with education. You … look for great teachers. You don’t … around. And you pay them, if you want your kids to be taught well. It’s just that simple”.

…

Ed. ellipses

you can bet this tax increase will not go to raising teacher pay or finding better quality teachers. It will go to admin pay raises and fancy new offices for them…

It’s kind of ironic. Mormons backing Donald Trump. He would be the guy to end handouts.

Well they are backing Trump its all they can do because Romney is out of it..! TRUMP FOR PRESIDENT.! LOL.!

Watch your taxes go up when 300-400 Somaliis get dumped here.

My parents paid for my education in a private school in another state. I have no children, why should I pay additional property taxes to educate (the hordes of) Mormon kids here? Maybe the LDS church should tithe 10% to Utah schools.